Assistant Professor Zhang Yapei at the School of Entrepreneurship and Management (SEM) at ShanghaiTech, together with her coauthors, Assistant Professor Sylvain Catherine at Wharton School of the University of Pennsylvania, and Professor Paolo Sodini from the Stockholm School of Economics, has recently found new evidence on the importance of countercyclical income risk in explaining households’ portfolio choices. Their findings were published in The Journal of Finance in the June issue. The paper is entitled “Countercyclical Income Risk and Portfolio Choices: Evidence from Sweden.”

The impact of expected labor income on household investment behavior has always been one of the core issues in household finance research. One view is that labor income risk is largely uncorrelated with stock returns, hence, more human capital leads to more demand for equity. However, this prediction is at odds with the reluctance of young workers to buy stocks and makes it more difficult to explain the equity premium. Another view is that, though uncorrelated with stock returns, labor income tail risk is countercyclical: disastrous career shocks are more likely when markets crash. This phenomenon is called “cyclical skewness” income risk. Households with higher “cyclical skewness” income risk should participate less in the stock market.

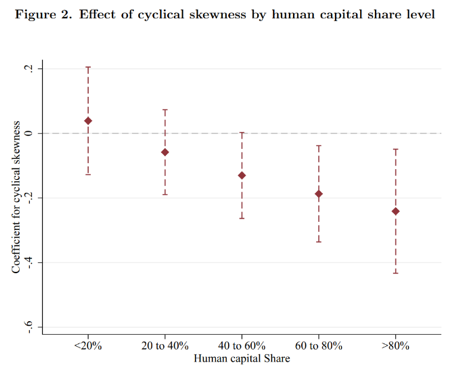

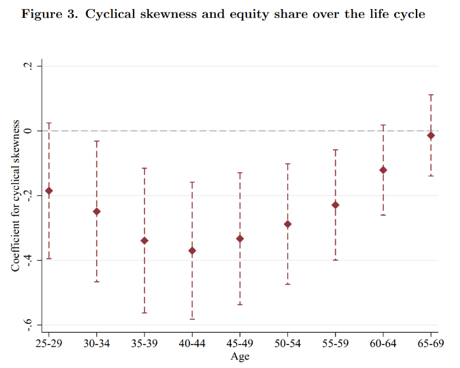

Using decades of universal income records from Sweden, this paper identifies workers exposed to higher “cyclical skewness” income risk and shows that they invest less in the stock market, both intensively and extensively. This effect holds even when comparing identical twins who share largely similar environments. Consistent with theory, this effect is stronger for workers whose human capital represents a greater share of their total wealth. Similarly, the effect slowly declines to zero as retirement approaches. The empirical results of this paper support the importance of correlated tail risk in explaining the “equity premium puzzle” and the “participation puzzle” in stock markets.

*This article is provided by Prof. Zhang Yapei